Profit Monday

Tutorial for: Profits & Gains

My failed "Profits-Only"

Trading Method!!

I canceled this version after 2 yrs of trying. I only made minor profits,

so I've adapted away from carrying heavy margins to basic option spreads & longer term swing trading above the 50ema with stop loses. However I'll keep this page for reference as a failed attempt. In essence, it ended up being the reverse of normal swing trading, & I bought most on the way down a trend, with low rsi dip buying rather than above 50ema trend buying. I've learned a lot from it, but I have to be far more serious and not hold onto losing stocks... Unless their margin cost per yr is covered by 1) their potential & 2) their dividends.

That is a mathy bit but worth it to determine, which stocks held are more costly than others. If you're up for it, update it with current #of shares, Take the margins yearly cost for the stock, the dividend yield into $. Then, if you have a list of stocks, rank them to find out which stock really is hurting your account. ie., current price, #of shares stock A = 36, *margin stock A = $200yr | dividend stock A = 180 yr, = -$20 to keep that stock at current price, & auto-update it for yield changes. * that formula involves knowing your current total all stock value, ie 50k, then your margin balance, 25k, then margin rate 12.5%, cost basis per stock, # of shares, multiple your current margin balance %, ie., 61% left, so 39% is margin balance, ie. $452, then x it by margin rate/ (days of margin yr (360)) to = 1 day of margin cost. and *360 for the entire yr. Not sure where I came up with 360 margin days instead 365? Long time ago.

% Technique of Therese:

Reversal Entries and Profit "Levels" for Exits.

This original tutorial page is intensive, & outdated due to my new Stock Calculator which helps to balance your Portfolio's while earning an income.

20k+ is recommended for Profit-Only.

You buy your own xlsx sheet and start loading it with your trades:

Included with your Portfolio Organization for Trading:

- your chosen basic profit %'s or unusual %'s per Stock

- your chosen Stock ratings

- Trade up to 46 Stocks at once

- Determinations supplied are: the exact # of shares to Buy or Sell per level, per Stock

- & it includes the Top 3 of your most profitable Stocks.

Great Tool that can't be missed.

Plus: it's designed to support Trade Manager careers also, where the account owner's account is not shared, only the trading data is shared, not the monetary account itself.

A Trade Managers job is to assist (via the shared sheet): From the top 3, which plotted stocks are best to trade, exact # of shares to buy or sell,

& the Account owner has more free time with less work to do. Allowing for the account owner to have more precise trades & they're still the actual trader of the stocks. A Trade Manager can be Good work for a friend or relative. Shared Chat is active on the sheet.

Stock Calculator for Profit-Only One-time Only fee. "Lowest Cost Basis not FIFO or LIFO"

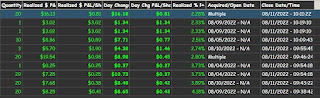

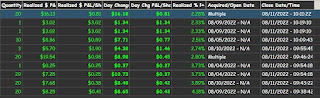

Profit Days this week:

Monday, Wednesday, Thursday, Friday,

& following Monday-Thurs, etc, avr. 4-5%

After 20 yrs of trading, even through the dot.com bubble,... I devised this trading system, due to the last few yrs, & recent bear market.

It's more "sim" style, w or w/o brackets, and not going with the weather. It's difficult to price-track sometimes, because of several purchase prices at different % levels, instead of one price at one %. Try to keep at least 5% distances between the price levels in slow times.

- Lower priced stocks variable distance 10%-15%

- medium priced to 5%-10%,

- higher priced 3%-8%,

depending on the stocks normal volatilty.

My method has gained during a bear market. Sadly though, I had to pay all of that away.

So, this weeks set in the images, shows the gains after a near-ruined account, yet still allowing for new profits, on the following week, Monday-Friday. Showing that even with great disruptions in leveraging power, it still proves to profit.

During this tutorial, note the green fonted positive profit images. At the end of the day, positive earnings provide a boost factor, which is great for new daytraders, as well. Day-trading isn't for everyone though... diligence, commitment and being defensive into entries & out of exits is simply required, unless using the Set & Go method shown below.

I designed this method, using %'s, with Profits collected 3-5 days per week from a collection of stocks,

& never selling at a loss.

Tuesday, in the example week, was at a "0" profit: making it a "waiting day", therefore, no "P&L" Tuesday image is shown.

For reference, my account is small in value, yet, I trade about 20 active stocks with it, from a watchlist of 30-40 stocks.

Profit Wednesday

Account Value & Settled Funds

You can use this method with accounts under $25,000, even better if over that amount.

Try not go below $3000 (settled) per account value of $20,000* (...or not below $9000 per account value of $60.000 and so forth.) with settled & ready-to-trade funds, because of the upsets from Margin Calls, that interfere with trading. Margin calls can Force selling at a loss, instead of selling at a profit. To avoid them: Bank on at least 2-3 days of severe market downturns.

On those days, wait out the drops under $3000, and resist buying unless you have money to add back into the account.

I've traded often when margin calls "begin", -100 margin calls every day & bringing it back to balance, for weeks at a time. It can be done, but in the end, you end up feeling like you're feeding a monster.

Plus, it's stressful to keep finding stocks to sell, within a battered portfolio, to bring it above 0 at the end of the day.

You usually end up sifting for the "least in losses", instead of trading for profits, and plotting for good entries.

*Taking overnight to monthly stock margin (not the full daily-allowed) is up to you, it can almost double the stock buying potential, but be aware of the fees: per $20,000 leveraged to $40,000, about $5-8 dollars per day = plan for approx: $200 per month, per $20,000 in negative allowed margin.

Use the

Order Amount Chart Helper to determine the cost to spend, per order level, per size of account.

Age & Stress Levels & the Bracket Gadgets

The "Set & Go", where you add a bracket "buy or sell" order, is better the older you are. Less chasing around for each stocks recent movement. However! You are pre-warning the system of your intentions. I believe institutional investors have access to bracket order counts. Begging the question, if too many brackets are pending, does the stock instead, reverse?

The "Bracket Order" setups are market orders, so choose a % that's far enough away so it still earns something. You can use conditional, but their tickets are tedious. I'm obviously wary of brackets, everything being electronic, and nearly pre-known. Remember to remove a conditional bracket if you close earlier, so it doesn't confuse with another set of the same stock.

This is not really a Trailing stops trade, unless added closer to the profit goal to avoid the stop-loss effect.

I've put the %'s as "the goal" in stone, but, if the trailing stop is added closer to profit % goal, well, you could get a few more %'s from time-to-time, it's more attentive work to the brackets themselves, though. Some people prefer to just watch the trade and be present, while others want to walk away from their platforms.

There is a weird bracket problem, where the US government with FINRA only wants people over $25,000, to be able to collect more money. So, if you set a bracket and the trade moves to your goal on the same day, you can easily go over the 3 per 5 trading days, allowance. (Nothing like that, a government who burns the poor, yet calls itself a democracy.)

Margin Requirements per Stock: with Options

This little choosy problem can upset a decent account, and send it into the hole way too quickly. Many prefer to buy or sell an option while trading a stock....

You can choose a few stocks that have high margin requirements, but be careful. You can watch $500 spent from $5000, become an account of $3000. Especially with Options. Losing your ability to trade over $1500 in other stocks.

Too many margin-required heavy stocks, and you'll just end up watching them and say, "What happened? they dropped & I can't get out. I'm locked out of trading until they profit." Losing precious time, for other stocks.

The requirements change often also, keep a sort column, on your watchlist, before deciding to go the gamut.

This includes trading less of the... "hard to borrows"

Out of 20, One or Two stocks with heavy margin requirements is fine. They tend to be either volatile, or simply put back for a long time, like "Joan" for instance.

Watch List

Maintain a good watchlist of current stocks & stocks you're willing to add into your portfolio. The sort will also help determine market direction for the day & week, for the group, plus it will help you find stocks at their lower lows.

%'s are easier on the eyes, and more exacting, for quick finds.

Positions & Watchlist Columns

-

5-day % , and daily % are required. They help determine quickly, who's dragging, vs who's over-purchased.

- Near those columns, keep the current trade price.

- Day's High, this little bugger will tell you if the stock is still pushing higher, or has given up for a while & "middled", or been sent into a drastic reversal.

- I like the 52 high & low %, especially when so many stocks are expressing a bear market.

50-75% set back from the high, means closer to its yearly low. Whereas, 5-30% from the yrs high, is a "be careful" on buying too many levels, it could reverse more than gain.

However, this is only a %, company specifics still can bring a high flying company that's only off 5% from its yrs high, even higher. IBM is an interesting one expressing, over & above performance this yr.

- A Vwap is ok, for entries & exits, but I don't always demand entries above the Vwap, it's like a stabilty indicator of short term direction & great timing helper more so.

- "Set" meaning: a "set"= 1 stock buy. "5 levels" = 5 stock buys*, of the same stock at various prices. *Max. 1-2 levels per drop day.

- Basic costs spent, is almost excessive info, as most stocks are nearly the same per "set".

However, Once you notice a group of levels, where the stock costs have added up too heavily, It does help remind you, to distance away from it for a while, and focus on others. Keep that column present, yet over on the far right, & use it specifically to stop over-buying a stock.

Charts

- Good indicators, Envelope, 20-day, 50-day, 200-day sma's. As guides-only for reference on degree of trend. However, not used as crossovers, or trade placing, more as a sentiment gauge. Note. there's slightly more risk for a longer-term hold, when buying below the 200-day. These 3 lines are Stock sentiment.

- I do use Bollinger, but don't adhere to it exactly, more as a "wow, it looks like a perfect entry".

Perfect entries are not required, and they don't always profit. They can look amazing, yet are more of a helper, "short term is trending long". But, this trade will experience many bollinger rises and falls, on its way to final profit.

- Vwap on the chart is also a great bonus for both entries and exits. Generally, price does push higher from the Vwap crossover. For a small time anyhow. I imagine Vwap-only scalpers exist.

- Volume: Interesting more so, indication of sentiment that can last for a few hours in certain cases. Usually, it's a past event though, and at best, possibly 2-3 more bars "your way" could be hoped for. A straight of 6 or more green or red volume columns is more of a rarity.

- Volume chart, with an Rsi. Use the smaller Volume chart with an Rsi. When the bar is at the bottom, it helps decision making for stronger buying-entries and when at the top, it helps indicate possible sell-offs.

- Adding Drawings: Either plot %'s entries with Envelope or ... add Horizontal bars for trade exits & entries, based on chosen %, I talk about them later in this tutorial.

Stock Quantity:

I might repeat this, during the tutorial, because it is one of the most important rule factors.

"Never over-buy 1 stock. Even when a great "dip occurs", the risk is still too high."

The long wait for its recovery could just go on for years, or even 'til they go bankrupt.

In some cases, it doesn't hurt to call the company directly,

find out from the "horses mouth" if they plan to be in business anymore, or if they're waiting on a product release.

When they go 'penny', I find myself asking, "Well,

I guess & a few others, paid for their new condo, or sports car, expensive dinners."

Trading Hours

Sorry, but this method requires, morning, mid-day checks on movements and closing participation sometimes.

Buying and selling occurs anytime, during the day. Heavier morning, or afternoons.

The more stocks on your "board", then, the more watchful you need to be, of the stocks themselves.

If you only trade 5 stocks, it's a lot less work obviously, but profit results may not be as high.

# of Stocks & Keeping Track of Them:

10-20 is fine. More stocks held is too difficult to keep track of via charts & sorting.

A 5-stock trader, will have less profit potential, because the drop wait-time will be longer.

However, alarms or limit-sell & limit-buy orders can be preset.

To not "go mad", use an external board, and/or notepad for stocks that are major movers for the next market morning.

Write down every "most likely" low entry, or high profit exit, before the market opens. Have your order tickets ready for those stocks, and you can trade right at the bell, or wait 'til the day sets its tone. Try to be calm, it should only be 5 maximum stocks effected for buys and sells, per early morning, per trading day.

I started using a magnet board with stock labels on the magnets, to fun way to set which stock is moving higher for the day. You can add, # of shares noted via colorful pins, or paperclips. Because, in a hurry,

"Seeing" 20 shares for this stock to sell, vs the 60 shares held, makes sure the last 40 shares are kept out of the sell.

A Magnet board: tin picture, placard or sign , covered with a plastic grid (found in sewing depts), with small magnets on its grid. (which slide around the board, like tron). Move them away from the price entry line, when in profit. Don't add any colorful* metal beads(not all metal, works on magnets) or the paperclip until the stock is in-trade. *colorful, where pink paperclips could = 50 shares. There's not a hardware version, maybe someday though. List the magnets, entry point, either Left to right (left=start, right = profit), or from the bottom to the top (bottom=start, top=profit).

Setting up Charts: Entries & Exits

- Set-up a dedicated chart for each stock. Most platforms allow for at least 6-9 per page.

- I use 1 larger "most active" chart surrounded by the smaller ones, to enlarge its view more, when its time to buy or sell a moving stock. Usually the larger chart window holds stock-names & chart settings for about 20 stocks. For each stock, it's easier to add the Horizontal bars only on this larger chart, less clicking.

- Keep a limit-buy or limit sell ticket, window nearby. Hunting around to load the ticket window can hurt profits.

- Keep track of the days trends on the platform, and use your positions page to sort-find max movers for sells & dips.

- You have to be fast and concentrate, reversals happen too quickly sometimes. Don't sit on a profit, if it states 4.5% and you wanted 5%, just take the 4.5%.

- Try not to price-chase an exit though, unless you're committed that it's a bad buy for a week or more. Price chasing an exit can lose all the profit % a very short time. "Get out, Get out" panic, when 5 minutes later, it can roar 2 dollars.

Exiting; Better to close, 1-2 pennies lower to get out of the trade. (even then, it can sometimes send you into a price-chase.)

- Entries: be prepared to bite 1 or 2 pennies of current price, in order to place the trade,

else watch it climb over 10-50 cents quickly and lose your entry, altogether.

What is this delay of the pennies? It could be slow internet access, no mouse at the ready, or .... the spook paranoia "someone, is trading against my profit potential, on purpose!" (which of course... they would attempt with me, because I'm an amazing stock trader.) Don't ask me about my missing millions, I just preferred to trade, then travel, now, I'm back to trading again, because I ran out of "Travel Money". No more Europe, until I make it back. I'll go back to Europe again, and this time, buy my huskies in Europe, instead of the plane travel for them. A goal is a goal, & you have to have some reason to trade, other than paying the bills. Trading is a total pain, it's consuming of your time and energy, it's not a job spent chatting around the water cooler & gossiping about people. It's a Total Dedication, Self-Employed career.

The Trade itself: Entries & Exits :

Envelopes, Horizontal Bars or the Decison of "Set and Go"

- For Envelopes, they are the easiest & quickest method of plotting vs horizontal lines, plus they do the % calculation for you.

I have a video tutorial here.

- Horizontals: Place entries based on recent 1-5 day highs, and setup a horizontal line (price to buy at) for it's reversal back... of at least 3-10% (depending on the stock type: higher% for cheaper stocks). If you absolutely love the stock & recent news, you can reverse from a higher range high, from a few weeks prior. Longer term higher range highs, though, should only be used for a small number of your stacks, due to risk of: longer wait on return.

- Setting up a lower horizontal line (of an entry color), helps immensely.

A 2nd higher line (of an exit color), for the exit price goal, once the set has been purchased. Add the #of shares to its label. "------------20"

- Multiple Levels: Keep all of their exit horizontal bars on the larger chart when the % goal per bar is reached, the horizontal bar helps you see exits.

i.e. only "1 set of 10 shares", at its horizontal bar exit goal $35.50, is to be sold. (tiered selling).

Therefore, profit's gained, only on those 10 shares, and the higher priced Levels,

are kept until their level is reached.

- Targets: Bear in mind, targets are not often reached in 1-2 days,

early profit taking of reduced %'s, is up to you.

- The "Set & Go" walk away version, pre-ordered price exits or entries with brackets...

Well, you can go this route, less active trading. Many new trade chances will be forfeited, so you'll be trading far less, which could be slower to profits.

- Discipline: The worst thing with this trade is when it reaches max profit, and the decision made is, "I'll stay and not collect right now, & let it go even higher". A quick reversal will burn the full % profit, more than the uprise potential (that day).

You can use the sma's and Vwap indicators, Rsi, etc. to add strength to your decision of keeping them for a few more % points. Sometimes, it pays off. Other times, it's just a waste of time to hope for more profit, during that hour or so. There's "the sure thing" vs "the possible", and discipline leans towards "the sure thing".

- After an exit: Don't look back in remorse, at what it could've been, if it jumps.

If it shifts 3 dollars higher, after your sell, so be it. Just be cold to that fact, and pull the new % drop, from that stocks newest high. Then add its new horizontal bar for its next trade entry. In massive jumps, I'm pensive to buy into % reversals of only 2-3%, 6-10% is normally less risky.

- Stock formation trends: Whether the stock trend forms as stair steps, or mountains? Bullish Mountains tend to allow for larger % reversals to gains. Bullish Stair steps have more mini % reversals intraday, when there are larger pre-market jumps.

- Support & Resistance: of course, major points that the stock taps into, are often direction changes, on the 3rd attempt.

- Scaling an exit (1 set of 30 shares with multiple sells i.e. 10 shares, 10 shares, 10 shares): I'm mixed on this, they're tempting though but, usually I lose minor profits in pennies per share on reversals. The choice of scaling is up to you.. Scaling entries, tends to run into over-buying. Pre-plan them, "Only 30 shares to buy, 10 shares each allowed."

- This trade really isn't a joke, the higher # of active stocks in conjunction with the smaller increments of share "levels" each, bring it success. After a while, you'll feel like you're running your own trading den. If there's a stock downturn, no matter; because instead of all shares at the highest price, a few levels are at lower versions.

In the old days, people did used to buy 100 shares of MSFT, and wait long term, the chances are way too high to get burned by buying that huge amount of shares all at once. The recovery time being way too long. That version turns stocks into a yearly bonus for Christmas presents, and "to inherit", instead of an income.

Setting %'s:

It's easier to maintain one % value for all stocks traded. Less decision-making in a hurry.

If 3% is your goal for most of your stocks,

the Envelope Indicator (plotted) (fastest method) or a calculator, to ascertain that price value.

However, with riskier stocks, you might prefer a higher profit % of 10 or 15%.

Calculator Manual %'s: So, if the most recent high is $60,

- Entry: the entry chart bar: horizontal bar is placed at $58.20... $60.00 - 3% = $58.20.

- Exit:... the exit chart bar: horizontal bar is placed at $58.94... $58.20 + 3% = $59.94

- Profit: for the above example, a good profit finish for it would be approx. $1.65 per share.

The Envelope Indicator can be a useful tool to determine % distances, set at 2-3 days, it's an annoying look though & horizontals still need to be drawn. Simply place a horizontal opposite from its recent high, at the peak of its bottom envelope line (exact time), & vice versa for the trade exit itself.

The Pivot Point Indicator, is too fluid going from a moving average, therefore it cannot be used to set exact % horizontals.

It's up to you to decide on a comfortable % goal, I can't state that for you.

& Once the % is detemined, it's actually a boring trade, on steroids because approx. 20 stocks on the trading table.

You have to act like a machine and be strict to those %'s & quick decisions.

Big Rule: Don't Just Buy "to Buy"

Stay with the best entries, else limit your potential.

# of Times a Stock is profit-traded per week

This cutie, depends upon the stock itself.

Some stocks sit for weeks and then move very well, while others can be profit-traded at least 3 times a week.

# of Shares to Stock Value

Go with Similar $dollar spends, regardless the current stock price.

However, I tend to buy less per set, on cheaper stocks under $10.

.i.e. for $300- on all stocks;

- 1 share) $300 msft

- 4 shares) $320 sbux

- 20 shares) $200 stock cheaper

- etc.

Total $Amounts per Stock, per Account Value;

Maximum of $850 per stock: for 20 stocks: per $20,000 in Account Value.(non-margin)

To trade at least 3 price levels of a stock, for those same 20 stocks,

then, the average order cost would be $283, or $850 in total.

Order Amounts & a Chart Helper: per Account Value;

This allows for either 3 trades or 5 trades per stock.

Obviously this is strict, but it is 20 stocks, try to maintain order amounts, around these number ranges.

It's still risk adverse, as $3000 (15%) is kept for excessive downturns (in settled funds), per $20,000*. *If margin is used, the amount can almost double, without a maintenance call.

3 Levels (price levels) per Stock

- $283 (3) :$20,000:

- $566 (3) :$40,000

- $849 (3) :$60,000

- $1132 (3) :$80,000

- $1415 (3) :$100,000

5 Levels (price levels) per Stock

- $170 (5) :$20,000

- $340 (5) :$40,000

- $510 (5) :$60,000

- $680 (5) :$80,000

- $850 (5) :$100,000

Profits per Set, by Cost of the Set:

3% exit is a basic goal & 10% is extreme w/slower results per stock.

1 Set:

$150

$300

$450

$600

$750

$900

$1050

$1200

3%

$4.5

$9

$13.5

$18

$22.5

$27

$31.5

$36

4%

$6

$12

$18

$24

$30

$36

$42

$48

5%

$7.5

$15

$22.5

$30

$37.5

$45

$52.5

$60

6%

$9

$18

$27

$36

$45

$54

$63

$72

8%

$12

$24

$36

$48

$60

$72

$84

$96

10%

$15

$30

$45

$60

$75

$90

$105

$120

Stop Losses:

My trading method is in preference to avoid them, due to wash creation and jumped-out losses.

Choose decent long-standing or viable companies, then reversals are more prone to be short term.

More money does have to be on the table, though, to accommodate for downtrends, while waiting for their upswing again.

You may end up with 5 or more "levels" of share purchase levels: per stock, during a bear esp.

However, in bull runs, i.e. the 5 levels tend to be picked up for profits within a month, with the worst portfolio stocks taking their time to recover.

I am not saying ban stop losses, just not-in-use for my "profit-only" trading method. Scalpers use them intraday, but that's just not this trading technique. My system banks on the rise of the market over time, and diversity of stocks.

With Stop losses: 10 reversals at a 8% pull-back profit loss, can really add up. When those losses are worked into the gains, well that's the traders choice, if it was the right way to go. I just think the stop % value, needs to change with the wind, and that's their % problem.

Profit Thursday

Cost Basis Set-up

Cost Basis: *Use Lower price Cost Basis method, Lowest cost (purchased) is the first sold,

In this way, if you're holding other shares of the same stock

& they were priced higher, you do not sell the older expensive shares, and lose.

**FIFO is wrong for most day-traders, esp. if you don't use stop losses, & keep some shares.

**First purchased means it is also: the first sold, which could have been from a purchase over a year ago at twice the current price, bringing a huge loss. Sadly most brokerage's setup FIFO as the automatic norm.

Profits & Gains

I usually never sell at a loss. I only collect profits per day. Which is nicer for the ego.

3-5 days of profit collection per week. Off days are; wait it out, predict direction trends, and seek low buys.

Reasons for selling at a loss? Only if dramatically needed to pay bills. & hopefully, it's only 1 stock, gaining that wash.

Waiting Days

On downward trend days, where no profits are on your board. Waiting Days: are fashioned to buy stocks and find good % entries. Once setup, the following day (or even later in the same day), can bring the reward.

Married to a Stock?

No problem with that, it's often stated to never be married to a stock. It's the opposite, if you have a diverse group of stocks, several in each sector, and it's a reliable stock, there's no reason to dump it and never return.

Obviously, be wary of major reversals, and look into the "why", if it's a small setback, and you already carry too much of the stock, then buy less of it after it's been "hit", so to speak. Most carry themselves out of bad news events, just don't overweight your portfolio with it, even at lower prices. (because the wait for a rebound could be way too long, reducing monetary movement goals for other stocks.)

If it performs very badly, and becomes a problem stock, you can:

1) Find another stock in the same sector.

2) Journal it to your 2nd account, and peek at it on occasion.

Penny Stocks

I don't day-trade penny stocks due to costs. Those are long and hold, for hopeful surprises.Trade with market sentiment, don't buy too much when the market appears too bullish.

When to Buy & Sell

Buy & Sell (for profit) nearly everyday.

This isn't a scalping trade. You do not have to force buying & selling of the same stock in one day. It's rare to daily pickup 5-10% on a stock, anyway, due to entries. The chances are way too high you missed the bottom, entered at the day's middle and it has strong resistance.

Holding overnight or waiting a few days to a week or more still allows for a decent % gain.

What Stocks ?

The stocks can vary, but some have an edge of volatile. Making them "Big Movers" vs others. "Big Movers" in both directions though. Buying a bank stock, i.e. can still supply profits, but the wait may be a little longer from 1 day to a week. I believe in a well-rounded portfolio, and the slower jumping stocks are necessary for a stable portfolio.

Try not to buy & sell the same stock in one day. It's rare to pickup 5-10% in a day bull run. Chances are way too high you missed the bottom, entered at the middle and it had a strong resistance. Holding overnight or a few days to a week allows for a decent % gain. It helps to create market volume & stock strength & reduces chop.

Brokerage Margin Temptress

Your account may give you daily potential buying power of $100,000 or $200,000, but how are you going to pay that back if the day trends into sour? or your kitchen starts on fire?

As well, it demands more scalping. & ending up in a margin call at the end of that day, would be hell.

My "Profit - Only" trade is not suited for that type of so-called daily freebie, due to stop losses being required for scalping.

Instead, Keep that $3000(per $20,000) as the lowest account value, and wait for rebounds.

Profit Friday

Holding Over The Weekends:

This is preferred. However, if a stock is at minimal profit and lacklustre in its trend potential, better to sell it, & begin again on Monday after reassessing its potential.

If it's in a reversal, and at a negative, well, it's simply sent into the "kitty" of levels, not in profit, until the stock recovers. This can't be an over-worry place either, most stocks recover, and long term investors exist.

Weekend: Margin

If your margin is expensive (large daily interest), in some cases it's better to take a small profit % from some lacklustre stocks, and just pay-off some bills.

However, there's not a rush to reduce all profitable shares, because it's only 2-3 days of interest. i.e. $3-$10 in interest charges (per -20,000). Some traders won't blink an eye, while others would demand to sell each Friday.

It's really about the stock itself, if it was purchased at a great low price, you could lose out on that "dip",

& its decent % gains of collection, the following week.

Weekend: Media Upsets

Rather, be safe than sorry? and sell? Well, it's only one day to the next, in market terms.

However, during those 2 weekend days, it's like 2 days of straight gossip or media news allowed to sink in.

Which could create Monday havoc. So, it's slightly riskier, to weekend hold. Where, Wars can be announced on Sunday, just to rub it in, making you feel that you should've sold it, at a stupid low, gain of $1.50 on a $1000 worth of a stock.

That's normally unusual though, "big market upsets". "Wars and Pandemic announcements",

I still find that it's better to keep a good dip buy, and just pay the interest, for its potential.

Gossip aside, go with the chance of a stocks potential & probable market direction in the next week,

and if you feel "iffy" then go ahead and drop it.

Weekend: New Market Direction

Exiting on Friday with minimal profits: chance extremes like a 5-day bull run, can still bring in a bullish Monday as well. However, the chance is higher for a bearish "correction" day.

Weekend: Trends & Educated Guesses

Exiting on Friday with minimal profits: these guesses, aren't really that educated, rather simply thought out and deemed as mixed, bearish or bullish.

The more bullish you feel, then keep more stocks, the more bearish then sell more, if mixed, then go with the stock itself as being weak or powerful in its trend.

Percentages: Goal 3-10%

Not to worry over an early "sell", if under that % goal. Esp. when the stocks trend changes.

Good judgement is still more important than the staid % goal.

Between the indicators & market sentiment and/or major stock news, (XY5! Devalued 30%).

Then...the initial % goal used for the exit, would need a modify, & an earlier exit taken at a lower profit.

Once you left the trade, with the lower profit, your account does free itself up again, for a different stock.

Timing for Trend directional Holds:

Intra-day, overnight, a few days, weekly, monthly.

A 1-5 day stock hold is normal for this trading style.

However, the drama with any Bear Directional Market, it takes a normal move and sends into a much longer wait time.

Options:

Options are not used in conjunction, which is less confusing for most people, it's simply my "Stocks-Only" method.

Most retirees can accomplish good trading using this system & Even during "stock crash" hype events, your account should still stay above margin-call territory, and be able to produce profits. Stay diversified.

Stocks that Fail

The market has moved in a steady uprise since its invention, however, new start-ups can be "corrected", all the way into penny stocks or bankruptcy.

As long as you don't include too many high risk companies, then any heavy reversals will just end up being par for the course. While the other stocks balance out your portfolio to bring in a steady source of income. Note: There are some stocks that are far lower than they were 20 yrs ago, yet those companies still exist and function. More for an inheritance gift towards someday.

Traders Donations:

If you profit, using my "Profits-Only" Technique; Please don't forget to send me a donation.

The expertise offered from my free tutorial & advice can help you earn a good living for the rest of your life:

The PayPal button is listed above, on the banner.

Also, donate some of your profits: to save the animals, and our planet.

I know this tutorial is kind of long winded, however, now the "Borgs" know how to trade, as well.

Disclaimer

if you only lose, that's really is going to be the question why? Only bad stock choices of non-standard stocks? No matter, this is a disclaimer: and trading to exacting potential or only into fail is the responsibilty of the day-trader. All stocks are at risk.